[ad_1]

Bangladesh is on track to record Asia's sixth-highest economic growth this fiscal year, but it is expected to remain well below recent averages and targets set by the government as economic pressures linger.

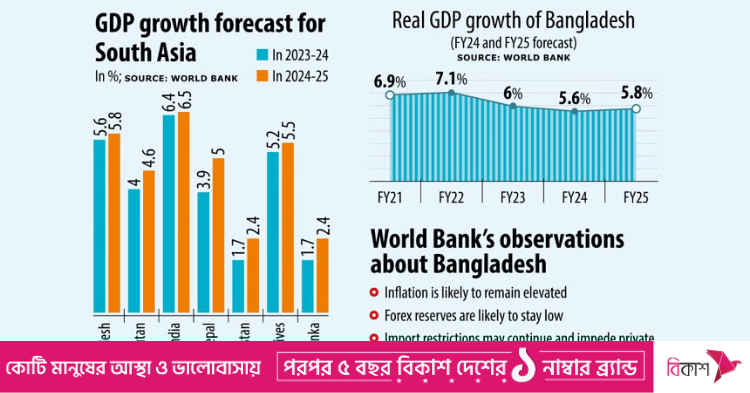

The country's gross domestic product (GDP) expansion is expected to slow to 5.6% in 2023-24, a change from the latest update in October, according to the World Bank's Global Economic Outlook report released yesterday. Not yet.

If this prediction comes true, this would be the lowest GDP growth rate in more than a decade, excluding the coronavirus-impacted 2019-2020. In fiscal year 2020, it fell to 3.4%, a 30-year low, due to the massive disruption caused by the nationwide lockdown imposed to limit the spread of the deadly virus.

The government has lowered its GDP growth target for fiscal 2024 from the original 7.5% to 6.5% due to factors such as import restrictions and rising material and energy costs that have slowed the economic growth rate to 6% in 2022-23. Decided to fix it. As well as external and financial pressures still persist.

“Increasing GDP growth is not our goal for this fiscal year. Our goal is to control inflation and increase foreign exchange reserves,” a finance ministry official said.

The World Bank said economic growth is expected to rise next fiscal year as inflationary pressures recede.

In Asia, which is made up of 48 countries covering the Pacific, East Asia, Central Asia, the Middle East, and South Asia, Cambodia, Mongolia, Palau, the Philippines, and India will outperform Bangladesh in terms of GDP growth in 2024.

Cambodia is expected to grow by 5.8%, Mongolia by 6.2%, Palau by 12.4%, the Philippines by 5.8%, and India by 6.3%.

While Bangladesh's GDP growth rate is lower than expected, the global economy is also slowing down. In fact, by the end of 2024, the global economy will have racked up a dismal record of the lowest five-year GDP growth in the last 30 years.

Global growth is forecast to slow for the third year in a row, from 2.6% last year to 2.4% in 2024, almost three-quarters of a percentage point below the 2010s average.

Growth in developing countries is expected to be just 3.9%, more than 1 percentage point below the average for the past decade.

“Without a significant course correction, the 2020s will be a decade of wasted opportunities,” Indermit Gill, the World Bank's chief economist and senior vice president, said in a press release.

Inflation is likely to remain high in Bangladesh, weighing on consumer spending, the Washington-based lender said.

The headline inflation rate averaged 9.02% in fiscal 2023, the highest in more than a decade, but it reached 9.49% in November and shows no signs of slowing down.

Import restrictions are expected to remain in place and discourage private investment, as foreign exchange reserves are likely to remain low, he said.

This means that Bangladesh will continue to face macroeconomic challenges caused by the sharp decline in foreign exchange reserves over the past two years. Reserves as of Monday were $20.38 billion, up from $40.7 billion in August 2021.

Public investment is expected to remain resilient.

According to the World Bank, the global economy is in better shape than a year ago and the risk of a global recession has receded, largely due to the strength of the U.S. economy.

“However, rising geopolitical tensions could pose new short-term risks to the global economy.”

Meanwhile, the medium-term outlook is cloudy for many developing countries, with growth slowing in most major economies, global trade sluggish and financial conditions at their tightest in decades.

Key consumer price inflation rates rose in 2023, primarily due to higher food prices and currency depreciation, resulting in monetary policy tightening. As foreign exchange reserves decreased, the balance of payments also deteriorated.

The increase in non-performing loans and other stressed loans has increased the vulnerability of the financial sector.

South Asia is relatively less open to trade, so the spillover effects of China's weaker-than-expected growth will be smaller than in other EMDE (emerging markets and developing economies) regions. But a sharper-than-expected slowdown in the world's second-largest economy could hurt growth in countries where China is a major trading partner and a major source of foreign investment.

“Furthermore, Bangladesh has seen slower-than-expected growth in its export destinations, particularly in the European Union, which could pose risks to its growth prospects,” the World Bank said.

While China is Bangladesh's largest trading partner, the EU accounted for over 46% of Bangladesh's export earnings in FY23, according to Bangladesh Bank data.

The World Bank report was prepared ahead of Bangladesh's parliamentary elections on January 7.

The report said parliamentary or national parliamentary elections are scheduled or planned for 2024 in many South Asian countries (Bangladesh, Bhutan, India, Maldives and Pakistan).

“Increased uncertainty surrounding this election could slow private sector activity, including foreign investment. Combined with increased political and social unrest and violence, this could further disrupt and weaken economic growth. There is a possibility that it will become

Furthermore, pre-election spending increases could exacerbate macro-fiscal vulnerabilities, especially in countries with weak fiscal positions.

“However, post-election policies that reduce uncertainty and strengthen growth potential could lead to improved prospects,” the Bank said.

[ad_2]

Source link

For all the latest news, follow The Daily Star's Google News channel.

For all the latest news, follow The Daily Star's Google News channel.